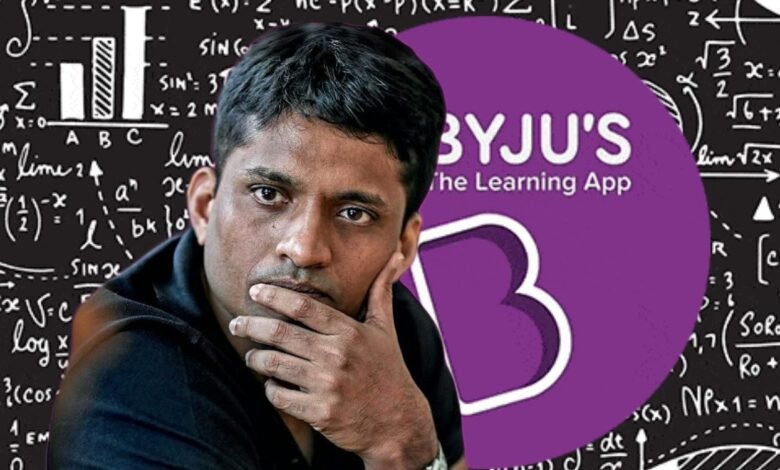

A new, explosive filing in a Delaware Bankruptcy Court has claimed that the missing $533 million from Byju’s US-based unit, Byju’s Alpha, was secretly “round-tripped right back to Byju Raveendran and his affiliates,” directly contradicting the edtech founder’s previous sworn statements. The founders of Think & Learn Private Limited (TLPL), the parent company, have vehemently rejected the allegations.

The latest claim emerged from a filing by Byju’s Alpha seeking approval for a settlement with OCI Limited, a UK-based procurement company that handled most of the disputed money. As part of this process, OCI’s founder, Oliver Chapman, submitted a sworn declaration detailing the flow of the funds.

Funds Allegedly Routed to Raveendran’s Singapore Entity

Chapman’s declaration alleges that the $533 million was clandestinely removed with the “intention that the vast majority of that money be moved (via a series of opaque transfers) to a corporate vehicle in Singapore—Byju’s Global—that Raveendran individually owned.“

- Of the $505.9 million OCI received between May and July 2022, approximately $479.6 million was allegedly transferred to Revere Master SPV LLC, a special purpose vehicle intended to route the funds to Byju’s Global in Singapore.

- An additional $13.1 million went to companies like Google and Sony India for procurement, while the remainder went to Rupin Banker.

This narrative sharply conflicts with Raveendran’s October 2024 sworn declaration, where he stated the funds were used for “legitimate commercial purposes” to procure “IT equipment, such as electronic tablets, and advertising.”

Byju’s Founders Call Testimony ‘Full of Conjectures’

In a statement released on Monday, Byju’s founders strongly denied the claims, calling Chapman’s testimony “full of conjectures and selective insinuations” that “does not substantiate any claim of wrongdoing.”

“The facts remain unchanged: No portion of the $533 million in question has been used by founders directly or indirectly. The said amount has been used in its entirety for the benefit of Think and Learn as evidenced in documents and bank statements,” the Byju’s statement asserted.

They further accused Glas Trust and the Resolution Professional (RP) of presenting “only partial/selective extracts, stripped of context” despite having “full access to the complete financial records.” They promised their forthcoming filing would provide evidence to rebut the assertions.

Separately, Raveendran’s legal team announced its intent to file claims against Glas Trust, seeking damages exceeding $2.5 billion for alleged violations, including racketeering and obstruction of justice.

The Downfall of a Former Edtech Giant

Byju’s troubles stem from raising a $1.2 billion Term Loan B in November 2021. By mid-2023, lenders alleged the $533 million was missing, leading them to attempt to take control of its special purpose vehicle, Byju’s Alpha. The US unit filed for Chapter 11 bankruptcy in Delaware in February 2024.

In India, the BCCI filed an insolvency petition in June 2024 over unpaid dues of Rs 158 crore, triggering corporate insolvency proceedings. The company, once valued at $22 billion, is now undergoing insolvency in both jurisdictions. Reports suggest that rivals like Ronnie Screwvala’s UpGrad and Ranjan Pai’s Manipal Group have submitted expressions of interest for TLPL.